Navigating the Enterprise AI Needs for Startups

Morgan Stanley recently released its 2Q23 CIO Survey, providing valuable insights into how enterprises are approaching data, AI, generative AI, and spending on related projects in 2023. The survey polled 100 CIOs and technology decision makers between May 4 and June 9, 2023.

Cloud and AI Remain Priorities Despite Macro Uncertainty

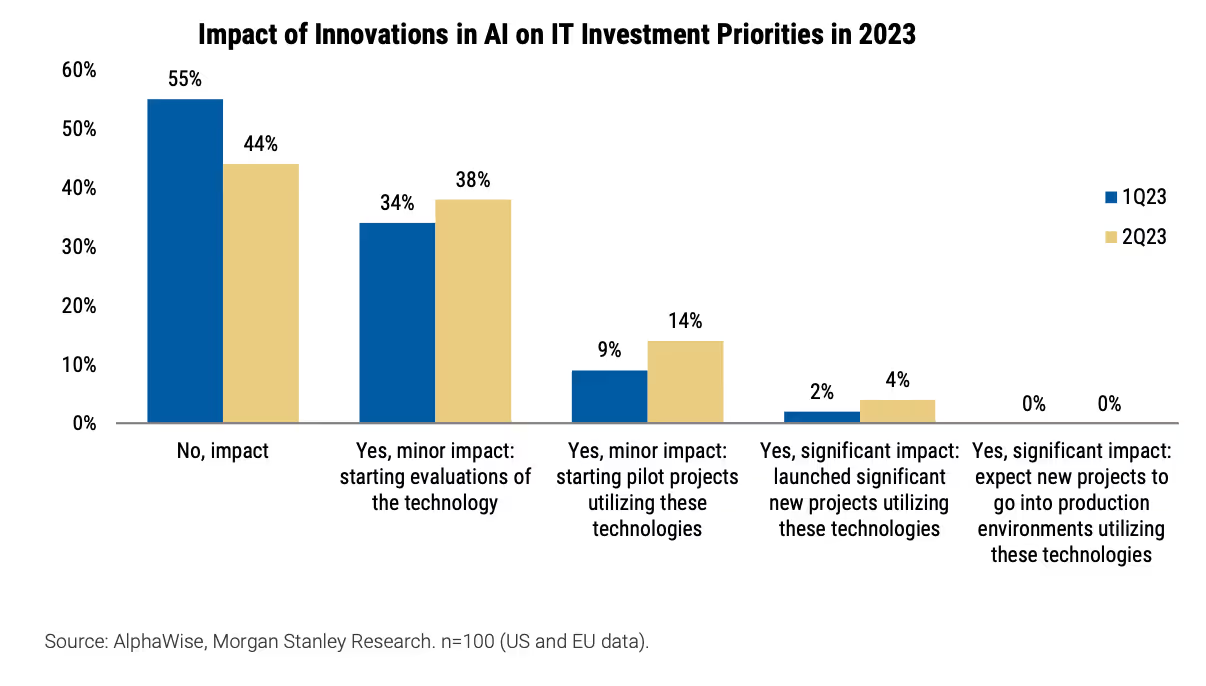

The overall results point to muted IT budget growth of +2.7% expected for 2023, below the pre-Covid average of +4.1%. However, cloud computing and security software topped CIO spending priorities this year. 56% of CIOs also said recent innovations in generative AI like GPT-3 are impacting their 2023 plans.

This underscores the continued importance of cloud migration and AI adoption, even with uncertain macroeconomics. As workloads shift to the cloud, Microsoft and AWS stand to gain budget share, while Dell, HPE and Oracle face risks of losing share. The survey found 29% of workloads now run in the public cloud, growing to 45% expected by the end of 2025 – indicating steady ~1-2% annual migration.

Microsoft Leads in Cloud and AI Capabilities

Microsoft stands out as a leader in both cloud infrastructure and AI. AWS followed Microsoft as the #2 vendor expected to gain wallet share from cloud migration. But CIOs overwhelmingly favored Microsoft for managing hybrid cloud environments, at 49% vs. 19% for AWS.

For generative AI capabilities, 47% of CIOs expect to use Microsoft's AI products like Azure OpenAI services over the next 12 months. This was far higher than other vendors and demonstrates Microsoft's dominant position in enterprise AI.

Data and Analytics Spending Remains Stable

The survey asked CIOs to rank IT spending priorities and provide budget change estimates for 2023. AI and data analytics initiatives continue to rank highly:

- Artificial Intelligence/Machine Learning rose to the #3 priority with 8.3% of IT budget allocated.

- Data Warehousing, Business Intelligence, and Analytics remained #6 with a 5.7% budget share.

- Database management and data storage saw a neutral consolidation score, indicating companies are not centralizing these purchases yet.

CIOs expect AI/ML spending to accelerate +3.0% this year, while analytics spending growth is expected to remain stable. Together this suggests steady spending on AI and data analytics projects in 2023 budgets.

Early Adoption of AI Yields Benefits

The survey also provided insights into enterprise AI adoption and benefits. While most CIOs are still evaluating, 7% indicated they have already achieved measurable benefits from AI and machine learning initiatives:

- 2% have seen major impacts from AI, launching significant new projects.

- 5% expect new AI projects to go into production environments this year.

- This indicates a small but growing cohort of AI leaders already advancing to production use cases.

However, the fact that most CIOs remain in the evaluation stage highlights that enterprise AI adoption is still in the early mainstream phase. Realizing measurable impacts at scale remains a journey for most.

Cost Matters

The survey results indicate an ongoing trend of IT vendor consolidation in the enterprise market. When asked about consolidating software purchases, CIO responses were neutral between best-of-breed and consolidation across categories like security, analytics, and databases.

However, 40% of CIOs stated they are consolidating IT services vendor relationships. Accenture and Deloitte were seen as the largest share gainers from vendor consolidation, while Cognizant, IBM, and Infosys were cited as the biggest share donors.

This data suggests enterprises are looking to reduce the complexity of their vendor ecosystems, especially in services. Startups companies should factor this into their go-to-market strategies.

The survey also provided perspective on vendor discounts. 37% of CIOs indicated tech vendors have become more aggressive with discounts over the past three months. This was driven by macroeconomic uncertainty and likely software companies competing to protect market share.

Of the CIOs planning initiatives to optimize external SaaS spending, most expect to achieve less than 10% in savings. This demonstrates that while discounts may be on the table, enterprises still value specialized solutions over the lowest price.

What Startup Companies Should Pay Attention To

For startups building innovative products in generative AI or data, this CIO survey provides valuable perspectives on penetrating the enterprise market. As most companies are still evaluating these new technologies, startups should focus on educating potential customers and making it easy to pilot their offerings.

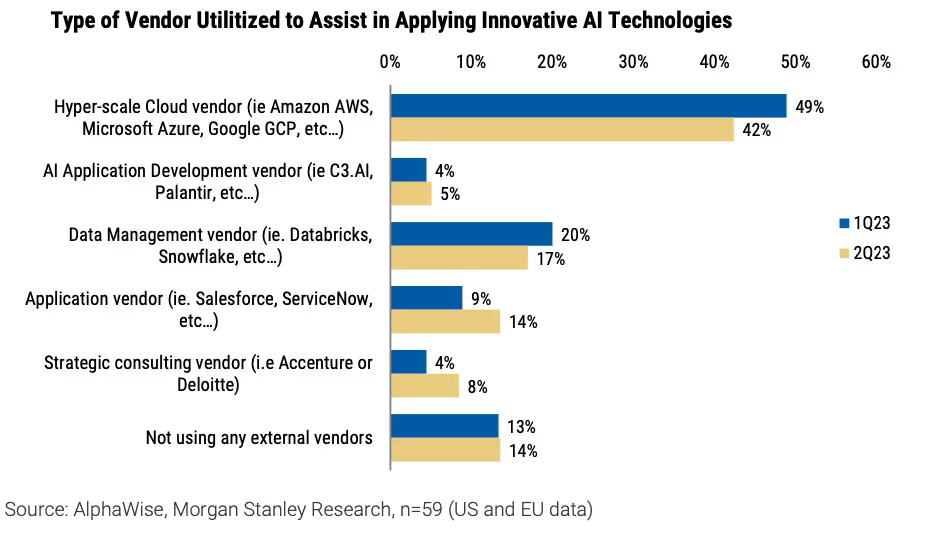

Key strategies include leveraging free trials, freemium models, and low-risk proofs of concept to get in the door and demonstrate value. Building awareness through content marketing and partnerships with systems integrators or established leaders such as Databricks, Snowflake, MongoDB, Microsoft and others can also be effective.

Once engaged, startups must provide exceptional service and make it seamless to scale from pilot to production deployments. Integrating with the hyperscalers like Azure and AWS can help by meeting enterprises where they are.

Overall, thought experiments around cutting-edge AI or data capabilities may intrigue CIOs. But realizing ROI means moving beyond the hype to drive tangible business outcomes. Startups prioritizing solving customers' pain points will be best positioned to convert interest into dollars.

For startups, maintaining flexibility around pricing and discounts could help win initial deals. But competing purely on cost is unlikely to drive sustainable growth. Differentiating on innovation and customer success will be the bigger determinant of long-term traction in the enterprise market.

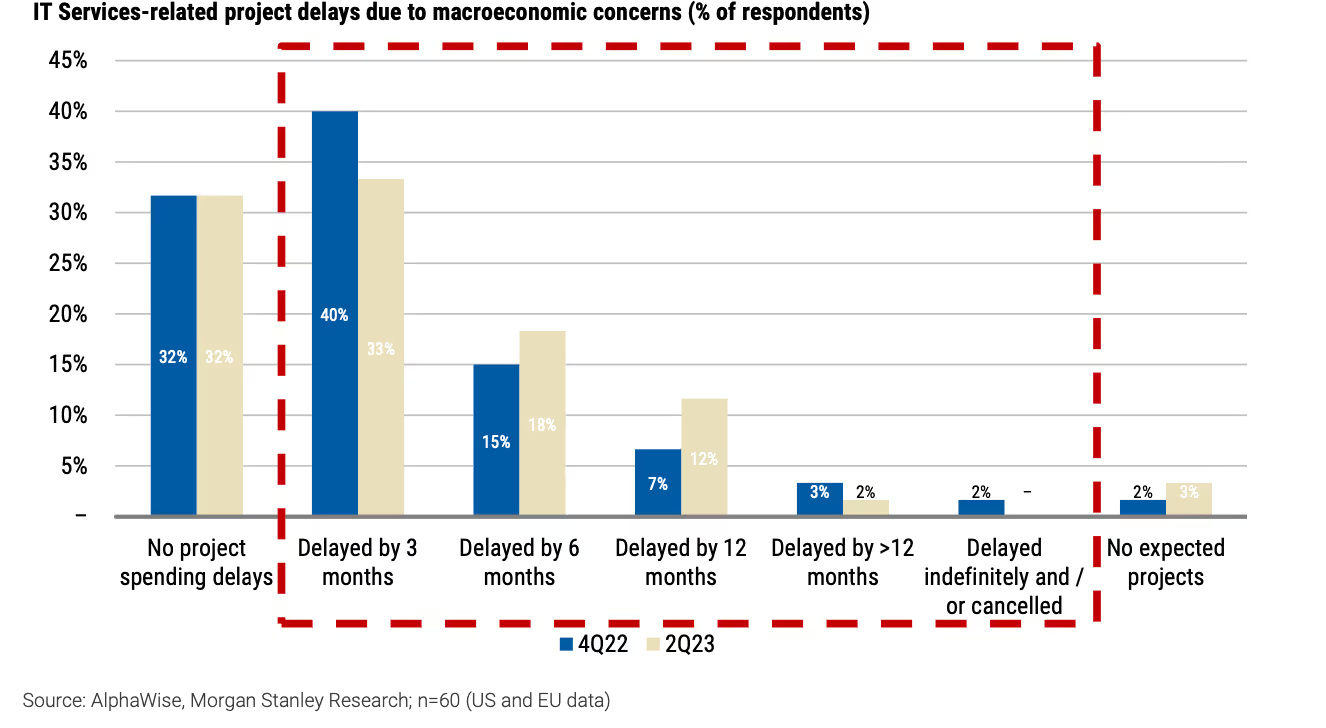

The survey results provide useful perspective on sales cycle trends in the enterprise tech market. When asked about delays in IT services projects due to macroeconomic concerns, 30% of CIOs reported delays of 6-12 months.

65% of respondents are delaying IT Services-related projects due to macroeconomic concerns, slightly below 67% of respondents polled in 4Q22, though we note a meaningful uptick in six to twelve month project delays, of which 30% of CIOs noted in 2Q23 (vs. 22% in 4Q22), underpinning broader moderation in spending initiatives amidst deteriorating macroeconomic conditions.

This highlights that sales cycles are elongating as enterprises take longer to evaluate purchases amidst uncertain conditions. Combined with the muted IT budget growth forecasts, it points to a more cautious approach to tech spending decisions.

For startups targeting enterprise sales, this means extending sales cycles and planning for longer pilots and proof of concepts should be expected. Having the funding runway to support longer periods from initial engagement to closed deal will be key.

Patience and persistence in follow-ups will also be crucial when selling into enterprises right now. With projects getting delayed, it is essential to stay top-of-mind with prospective customers and re-engage at the right time as budget opens up.

Startups that adapt their outreach cadence and sales workflows to match the new realities of elongated enterprise sales cycles will be better positioned to drive growth.

The Path Ahead for AI and Data

In summary, the Morgan Stanley CIO Survey spotlights cloud, AI, data and security as ongoing top priorities, with Microsoft leading in multiple areas. While macro uncertainties persist, IT leaders appear committed to advancing their data-driven digital transformations with AI in 2023 and beyond. As more enterprises move AI projects into production, measurable benefits are expected to accelerate. If you are a startup founder building in the Data and AI space, the opportunities in the next 3 - 5 years to come are huge. However, monetization is going to be a challenge especially due to long sales cycles, consolidation and competition. It is critical more than ever, to come up with a solution that drives unparalleled amount of tangible value to the enterprise. Nice to have solutions, altough might be innovative will probably not last.

.jpg)